What is PPF Public Provident Fund Account: PPF Account Benefits: Friends, in the tax saving and savings schemes run by the Government of India, PPF i.e. Public Provident Fund! The most important saving and tax saving scheme is in this scheme as well! You are also given a complete guarantee of the security of the money deposited by you from the government. Interest is given to you under this scheme at the rate of 7.1%.

PPF Account Benefits: Any Indian citizen can get the benefit of this savings and investment scheme of the government. Friends, if we talk about the interest rate, then with PPF account you can get better and better returns than bank fixed deposits. Opening this account and depositing money in it is completely voluntary. ppf The account also gives you tax exemption under section 80C of the Income Tax Act.

PPF Account Benefits: The entire responsibility of the implementation of this account lies with the Government of India. And the interest received on this account is also given to you by the Government of India. PPF account account can be opened with the help of bank or post office. PPF by Govt. Completely exempted from tax! That is, you do not have to pay any kind of tax on the withdrawal made from it.

ppf Benefits Of PPF Account : PPF Account Benefits: Friends, if you talk about the benefits ie benefits from PPF account, then this investment scheme is a much better scheme! This is the reason why people invest heavily in this scheme. Because this scheme provides you many other benefits apart from giving you income tax exemption which are as follows!

Benefits Of PPF Account : PPF Account Benefits:

PPF by the government. Guaranteed return on investment is assured under the scheme! Therefore this scheme is safe from the point of view of investment and security. Under this scheme, interest is given to you at the rate of 7.1% on the basis of compound interest. Which gives you better interest on your total deposits under this savings and investment scheme.

Investors are eligible to withdraw funds from PPF account in case of emergency. PPF Account Benefits: Under the scheme, all investors can get the benefit of exemption up to 1.50 lakh under section 80C of the Income Tax Act 1961. Interest is calculated after the 5th of every month under the scheme. If the investor keeps on contributing to the contribution made by him before this fixed date, then his profit keeps on increasing. All the members of a family whether they are employed or businessmen can open their PPF account.

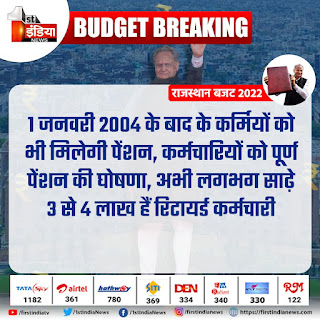

રાજસ્થાન 2004 પછીના ને પણ માં જૂની પેન્શન યોજના લાગુ ન્યૂઝ માટે અહી ક્લિક કરો

રાજસ્થાન 2004 પછીના ને પણ માં જૂની પેન્શન યોજના લાગુ માટે અહી ક્લિક કરો::Facebook live

If parents want, they can also open PPF account for their children. After which the account will have to be operated by the guardians or legal parents till the child becomes a child. PPF Account Benefits: This scheme is very beneficial for low and medium income group. Because the minimum annual investment and maximum annual investment under this scheme is between Rs 500 to 1.50 lakh!

This scheme encourages small savings and investments. So that enough opportunities for saving and investment can be made available to the people. More than one person can be appointed as a nominee under the account. Provided that it is mandatory to give the details of the nominee in this regard.

Features of PPF Public Provident Fund Account:

PPF Account Benefits: Friends, if we talk about the features and benefits of PPF Public Provident Fund Account, then PPF is the most popular government scheme from investment point of view! Under this scheme, you are given compound interest on your investment by the government at the rate of 7.1%. This is the most important feature of PPF account! That it does not matter the age limit or whether you do a job or business! This account can be opened by you very easily!

Key Features of PPF Account: Long Term Investment:

PPF ie Public Provident Fund is a long term investment plan. If we talk about withdrawal, then withdrawal from PPF account can be done only after the completion of 15 years. Its total maturity period is 15 years. Later, if you want, after the completion of 15 years, you can extend it for another 5 years. Under this, premature withdrawal of money is allowed only in situations like emergency and emergency.

If parents want, they can also open PPF account for their children. After which the account will have to be operated by the guardians or legal parents till the child becomes a child. PPF Account Benefits: This scheme is very beneficial for low and medium income group. Because the minimum annual investment and maximum annual investment under this scheme is between Rs 500 to 1.50 lakh!

This scheme encourages small savings and investments. So that enough opportunities for saving and investment can be made available to the people. More than one person can be appointed as a nominee under the account. Provided that it is mandatory to give the details of the nominee in this regard.

Features of PPF Public Provident Fund Account:

PPF Account Benefits: Friends, if we talk about the features and benefits of PPF Public Provident Fund Account, then PPF is the most popular government scheme from investment point of view! Under this scheme, you are given compound interest on your investment by the government at the rate of 7.1%. This is the most important feature of PPF account! That it does not matter the age limit or whether you do a job or business! This account can be opened by you very easily!

Key Features of PPF Account: Long Term Investment:

PPF ie Public Provident Fund is a long term investment plan. If we talk about withdrawal, then withdrawal from PPF account can be done only after the completion of 15 years. Its total maturity period is 15 years. Later, if you want, after the completion of 15 years, you can extend it for another 5 years. Under this, premature withdrawal of money is allowed only in situations like emergency and emergency.

No comments:

Post a Comment